It is a course in practical accounting and bookkeeping designed to teach you how to keep the books of a small company just like your own. We have woven the theory and practice of accounting together. The accounting course is meant to give small and home business people and others a solid understanding of the language of business so that they can better run their companies or perform their jobs.

~~

WHAT WILL YOU LEARN IN THE ACCOUNTING COURSE?

The important topics that will be covered in the accounting course are:

* Basic accounting concepts, principles and terminology.

* Debits and credits.

* Double entry accounting.

* Types of business entities and enterprises (and their advantages and disadvantages).

* How to set-up and keep a set of books for a small business.

* How to journalize business transactions.

* How to reconcile your bank account.

* How to adjust the books at the end of the fiscal period.

* How to post to a general ledger.

* How to compute payroll.

* How to depreciate assets.

* How to create and understand a Balance Sheet.

* How to create and understand an Income Statement (also called a Profit and Loss Statement or P & L).

~~here's a short list of the people it might benefit.

Are you ...

* an entrepreneur?

* running a small business?

* running a home business?

* a professional running your own practice?

* just starting your own business?

* thinking of starting your own business?

* a manager in a company?

* an office manager with bookkeeping duties?

* an administrative assistant with bookkeeping duties?

* a bookkeeper or accounting clerk who has learned on the job and needs to understand the concepts in order to do your job better or be promoted?

* an investor who would like to understand where the numbers are coming from on the financial statements that you read?

* Someone who has taken an academic accounting course and still doesn't know a debit from a credit?

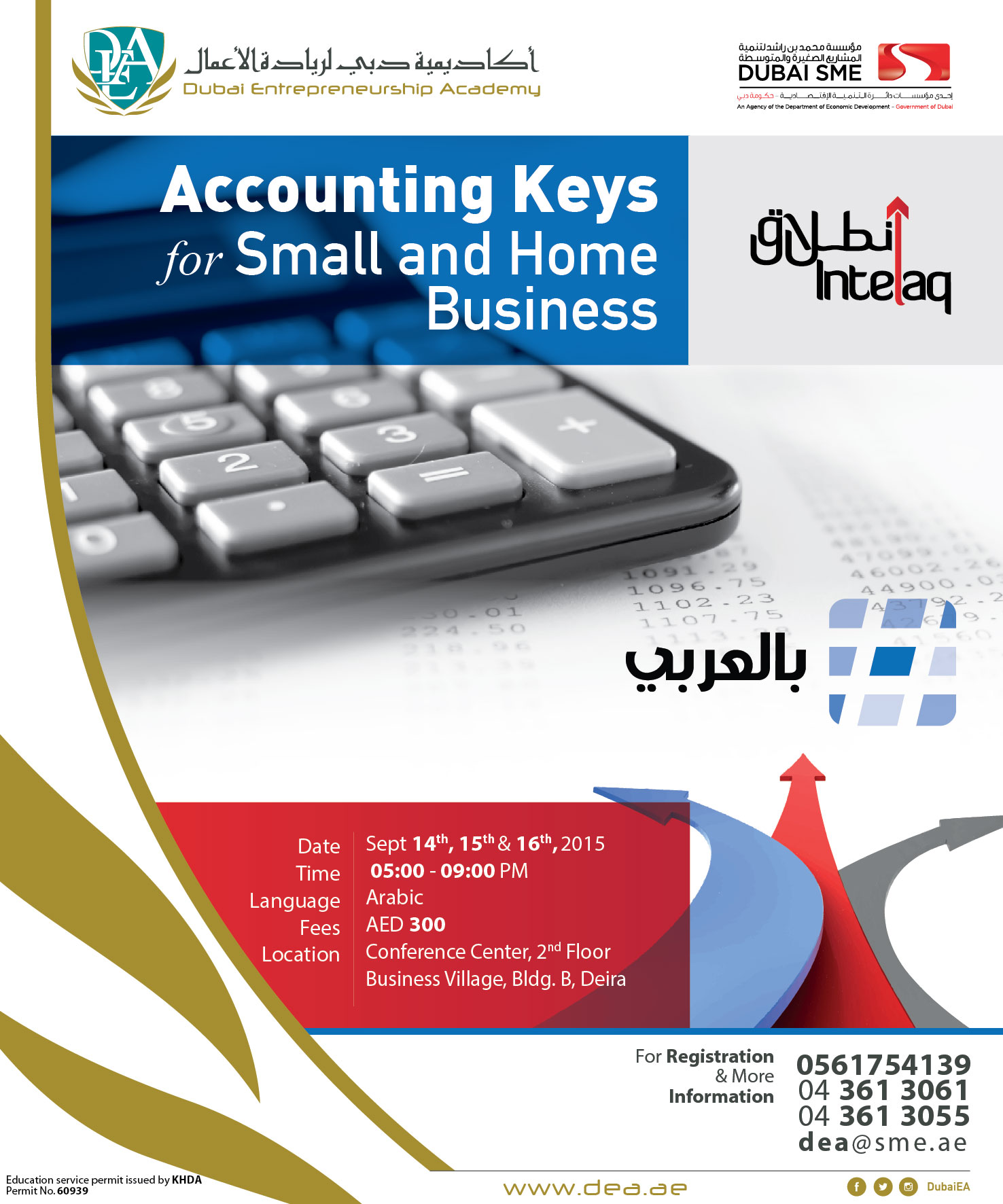

Business Village, Diera, Block B. 2nd Floor, conference center

Business Village, Diera, Block B. 2nd Floor, conference center

Business Village, Diera, Block B. 2nd Floor, conference center

Business Village, Diera, Block B. 2nd Floor, conference center

Business Village, Diera, Block B. 2nd Floor, conference center

Business Village, Diera, Block B. 2nd Floor, conference center

No records found